XRP Price Prediction: Navigating Consolidation for a Potential Breakout

#XRP

- Technical Crossroads: Price is below key moving averages but above crucial support, requiring a break above $2.15 to shift momentum bullish.

- Strong Institutional Backing: Record ETF holdings and 7-year high whale accumulation create a substantial demand base beneath the market.

- Regulatory & Competitive Landscape: New CFTC-regulated trading venues aid legitimacy, while developments in stablecoins present evolving competition for cross-border use cases.

XRP Price Prediction

Technical Analysis: XRP/USDT Trading Pair

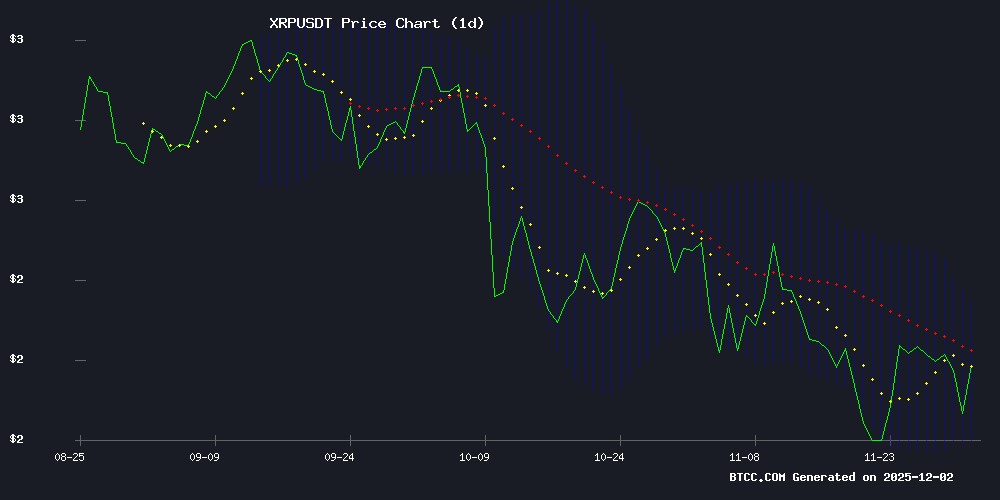

XRP is currently trading at $2.0261, below its 20-day moving average of $2.1452, indicating a short-term bearish pressure. The MACD histogram is negative at -0.0184, with the signal line above the MACD line, suggesting weakening momentum. However, the price is positioned above the lower Bollinger Band ($1.9363), which may act as a support level. The middle band at $2.1452 and the upper band at $2.3542 represent immediate resistance and a potential bullish target, respectively. According to BTCC financial analyst Robert, 'The technical picture shows consolidation. A sustained hold above the $2.00 psychological level could set the stage for a retest of the 20-day MA. A break above the middle Bollinger Band is needed to confirm a shift in short-term sentiment.'

Market Sentiment: Institutional Buildup Amid Volatility

The news flow presents a mixed but institutionally supportive backdrop for XRP. Headlines highlight significant ETF inflows amassing $648 million and whale holdings reaching a 7-year high, signaling strong accumulation during market weakness. The launch of new regulated trading products, like Bitnomial's CFTC-regulated platform, and a leading $1.07B crypto fund influx where XRP played a key role, point to growing mainstream infrastructure and capital allocation. However, sentiment is tempered by mentions of key resistance, broader market downturns, and competitive threats from developments like Visa's stablecoin push. BTCC financial analyst Robert notes, 'The fundamental narrative is bifurcated. Record institutional holdings and product development are powerful long-term bullish drivers, but in the near term, price action is wrestling with macro headwinds and technical resistance. The controlled unlock by Ripple adds a layer of predictable supply pressure that the market is learning to price in.'

Factors Influencing XRP’s Price

XRP ETFs Amass $648M in Holdings Despite Market Downturn

US-based XRP exchange-traded funds have rapidly accumulated 318 million XRP tokens, valued at approximately $648 million, across four major providers. The collective assets under management, including the REX-Osprey fund, now exceed $775 million despite XRP's price retreating to $2 during a broader crypto market decline.

Canary Capital's XRPC ETF dominates the nascent market with $347 million in assets and record-breaking first-day trading volume for a 2025 ETF launch. "This isn't just early adoption—it's validation of institutional demand," said Steven McClurg, Canary's CEO, highlighting investor preference for regulated exposure to the XRP Ledger's native token.

XRP Whale Dynamics Signal Market Consolidation as Holdings Reach 7-Year High

The cryptocurrency market closed the month under pressure, with Bitcoin briefly falling below $84,000 and XRP dipping to $1.98 before recovering. While both assets have rebounded—BTC above $85,000 and XRP holding $2—the specter of a deeper correction looms as trading volume spikes 180%.

An unusual divergence emerges in XRP whale behavior: 569 major wallets vanished in eight weeks, yet remaining whales now hold 48B XRP—their largest accumulation since 2017. This suggests a market consolidation where exiting players' supply is absorbed by persistent institutions.

The contraction of 100M+ XRP wallets (-20.6%) contrasts sharply with the seven-year high in concentrated holdings. Such divergence often precedes volatility, as thinner whale participation amplifies price swings during liquidity events.

Canary Capital's XRP ETF (XRPC) Dominates as Largest U.S. Spot XRP Fund

Canary Capital’s XRP ETF (XRPC) has eclipsed all competing U.S. spot XRP ETFs with $336 million in assets under management as of November 26, 2025. The fund’s debut marked a record $59 million in first-day trading volume—the highest launch figure for any ETF this year.

XRPC provides regulated exposure to XRP, the native token of the XRP Ledger, reinforcing Canary Capital’s expansion in digital asset investment products. This follows their recent HBAR ETF (HBR) launch.

"This isn’t just early adoption—it’s validation," said Steven McClurg, CEO of Canary Capital. Investor demand has propelled XRPC to market leadership within weeks of inception.

Bitnomial Prepares to Launch CFTC-Regulated Spot Crypto Trading

Bitnomial, a Chicago-based derivatives exchange, is set to introduce spot crypto trading under CFTC oversight after its self-certified rule updates took effect on November 28. The move positions Bitnomial as the first U.S. exchange to offer spot digital asset trading directly regulated by the CFTC, a role traditionally limited to futures and derivatives venues.

The development follows a rare joint statement from the SEC and CFTC in September, which confirmed that certain spot crypto products can be listed under existing law. Bitnomial leveraged this guidance, arguing that the Commodity Exchange Act already grants the CFTC authority over leveraged retail spot trading. The exchange previously made history in March 2025 by launching the first CFTC-regulated XRP futures.

Spot trading could go live within days, marking a significant milestone in U.S. crypto regulation as Congress continues debating a broader framework. Bitnomial's approach demonstrates how existing rules can accommodate innovation while maintaining compliance.

XRP Leads $1.07B Crypto Fund Influx Amid Fed Rate-Cut Optimism

Crypto investment products witnessed their strongest weekly inflows on record, with $1.07 billion reversing a month-long exodus. The rally was spearheaded by XRP, reflecting renewed institutional confidence as traders price in potential Federal Reserve easing.

Market sentiment has pivoted sharply from last month's risk-off posture. The inflows suggest hedge funds and family offices are reallocating to digital assets ahead of anticipated monetary policy shifts.

BlockchainFX and XRP Emerge as Top Crypto Contenders Amid Cyber Monday Surge

As Cyber Monday winds down, two digital assets are defying typical year-end slowdowns. XRP maintains its dominance in cross-border payments while BlockchainFX—a newly licensed trading platform bridging crypto and traditional markets—is attracting presale investors with its $0.03 entry price ahead of a projected $0.05 launch.

The Anjouan Offshore Finance Authority's endorsement of BlockchainFX marks a rare regulatory milestone for hybrid trading platforms. With $11.6 million raised from 18,700 participants, the project nears its $12 million soft cap, leveraging momentum from its international trading license and limited-time incentives.

Meanwhile, XRP's established infrastructure continues to anchor institutional payment flows. The simultaneous rise of both assets underscores a bifurcated market: one favoring proven blockchain utilities, the other rewarding innovative regulatory compliance.

Ripple's Controlled XRP Unlock: Market Impact and Strategy

Ripple will release 1 billion XRP from escrow on December 1, continuing a program established in 2017 to manage supply transparency. Only 200-300 million XRP typically enters circulation monthly, with 70-80% re-locked to prevent market flooding. This measured approach aims to fund ecosystem growth while mitigating price volatility.

Historical data shows minimal price disruption from these unlocks. The full escrow is projected to unwind by 2035, maintaining predictable supply dynamics. Liquidity provisions and institutional sales absorb much of the released tokens, cushioning retail market impact.

XRP Technicals Hint at Impending Breakout as Investors Diversify into SolStaking

XRP's price action is mirroring the technical setup that preceded its 2024 rally, with a descending channel formation and higher RSI lows signaling potential accumulation. A breakout above key resistance could confirm a trend reversal, but timing remains uncertain.

While awaiting XRP's next move, savvy investors are turning to SolStaking for reliable daily yield. The protocol offers market-agnostic income streams, allowing participants to maintain crypto exposure while generating cash flow during consolidation phases.

The strategy reflects growing sophistication among digital asset holders, who increasingly balance speculative positions with structured yield products. SolStaking's rise coincides with renewed institutional interest in blockchain-based financial infrastructure.

XRP Price Prediction Turns Bullish as Institutional Interest Grows, While Remittix Attracts Whale Attention

XRP is showing renewed strength, with analysts turning cautiously bullish as institutional inflows and technical signals improve. Bitwise and 21Shares' new ETFs are driving demand, while European and Asian financial providers adopt XRP for cross-border payments and payroll systems. Ripple Prime and RLUSD integration further bolster Ripple's institutional appeal.

Despite bullish fundamentals, XRP's price remains range-bound between $2.20 support and $2.24-$2.25 resistance. Mixed technical indicators—bearish MACD, neutral RSI, and exhausted Stoch RSI—suggest short-term caution.

Meanwhile, XRP whales are increasingly diverting attention to Remittix, a payment-focused project gaining traction for its real-world utility. Some view it as a potential complement or even competitor to XRP's long-term trajectory.

XRP Faces Key Resistance Amid Broader Market Downturn, Analysts Predict 10X Rally in Alt Season

XRP struggles against a dynamic resistance level at the middle Bollinger band, shedding 7.6% over 24 hours to trade near $2.03. The decline mirrors mounting bearish pressure across cryptocurrency markets.

Despite the short-term weakness, analysts anticipate a parabolic move during the next altcoin season. "The rally will be 10X bigger," one observer notes, suggesting suppressed volatility may precede a dramatic upside breakout.

Visa's Stablecoin Push Challenges XRP as DeepSnitch AI Gains Traction

Visa's partnership with Aquanow to expand stablecoin settlements across Europe, the Middle East, and Africa marks a pivotal shift in payment infrastructure. The focus on African markets—where remittance fees are punitive and banking systems lag—could redefine cross-border transactions by slashing costs and processing times from days to minutes.

This move pressures payment-focused cryptocurrencies like XRP, now testing critical support levels. While HBAR grapples with bearish trends, DeepSnitch AI's presale surpasses $620K, launching soon with live tools designed for volatile markets. Visa's institutional-grade solution underscores a broader trend: traditional finance is co-opting blockchain's efficiencies, leaving native crypto assets to compete for niches.

How High Will XRP Price Go?

Based on the current technical setup and fundamental news, XRP is in a consolidation phase with a bullish undercurrent from institutional activity. The immediate path will be determined by its ability to overcome key technical levels.

| Scenario | Price Target | Key Condition |

|---|---|---|

| Bullish Breakout | $2.35 - $2.50 | Sustained close above the 20-day MA ($2.1452) and Middle Bollinger Band, fueled by continued ETF inflows. |

| Continued Consolidation | $1.94 - $2.15 | Price oscillates between the Lower and Middle Bollinger Bands as it digests whale accumulation and Ripple's unlocks. |

| Bearish Breakdown | Test of $1.80 | Failure to hold the Lower Bollinger Band support ($1.9363) amid a broader market sell-off. |

BTCC financial analyst Robert summarizes: 'The $648M in ETF holdings is a concrete vote of confidence that provides a solid floor. For a significant rally towards the $2.50 region or the '10X' some analysts mention, we likely need a clear altcoin season catalyst combined with a decisive break above the $2.35 resistance. The more probable near-term outcome is choppy trading within the current band, building energy for the next major move.'